2024 세무회계연습 1: 법인세법 또는 왜 우리는 쉽게 잊고 비슷한 일은 반복될까요

땅끝

2024-12-19 07:52

129

0

본문

2024 세무회계연습 1: 법인세법

도서명 : 2024 세무회계연습 1: 법인세법

저자/출판사 : 김문철, 가치산책컴퍼니

쪽수 : 784쪽

출판일 : 2024-03-11

ISBN : 9791192070988

정가 : 34000

PART 01 법인세법

CHAPTER 01 법인세법 총론 ························ 10

실전문제 01 법인세계산구조 ··································· 27

실전문제 02 결산조정사항과 신고조정사항 ············· 31

실전문제 03 소득처분 ············································· 34

실전문제 04 유보의 추인(2001. CTA) ···················· 38

실전문제 05 사업연도가 6개월인 경우

세무조정 및 세액의 계산 ···················· 44

CHAPTER 02 손익의 귀속시기와

자산·부채의 평가 ·················· 50

실전문제 01 자산의 일반적인 판매손익 ·················· 72

실전문제 02 할부판매(Ⅰ) ······································· 74

실전문제 03 할부판매(Ⅱ)(2011. CTA) ···················· 79

실전문제 04 할부판매(Ⅲ)(2018. CTA) ···················· 80

실전문제 05 할부판매(Ⅳ)(2020. CTA) ···················· 83

실전문제 06 손익의 귀속시기

- 도급공사손익(Ⅰ)(2002. CPA) ········· 85

실전문제 07 손익의 귀속시기

- 도급공사손익(Ⅱ)(2007. CPA) ········· 87

실전문제 08 손익의 귀속시기

- 도급공사손익(Ⅲ)(2016. CPA) ········· 89

실전문제 09 손익의 귀속시기 - 자영공사손익 ········ 91

실전문제 10 손익의 귀속시기 - 수입이자 등 ········· 92

실전문제 11 손익의 귀속시기

- 임대료와 수입배당금 등 ················· 94

실전문제 12 손익의 귀속시기 - 전기오류수정손익(Ⅰ) ·· 97

실전문제 13 손익의 귀속시기

- 전기오류수정손익(Ⅱ)(2016. CPA) ·· 99

실전문제 14 자산의 취득원가 ······························· 101

실전문제 15 자산의 취득원가 등(2020. CPA) ······ 103

실전문제 16 채무의 출자전환 ······························· 105

실전문제 17 재고자산 평가(Ⅰ) ····························· 107

실전문제 18 재고자산 평가(Ⅱ)(2022. CPA) ········· 109

실전문제 19 재고자산 평가(Ⅲ)(2005. CPA) ········· 111

실전문제 20 재고자산 평가(Ⅳ)(2017. CTA) ········· 113

실전문제 21 재고자산평가차익 익금불산입 ··········· 115

실전문제 22 유가증권 평가(Ⅰ) ····························· 116

실전문제 23 유가증권 평가(Ⅱ) ····························· 120

실전문제 24 유가증권 ··········································· 122

실전문제 25 외화자산·부채 평가 등 ··················· 123

실전문제 26 자산·부채 평가(2014. CPA) ··········· 125

실전문제 27 자산·부채의 평가 - 종합(2023. CPA) · 127

실전문제 28 장기금전대차거래 ······························ 130

CHAPTER 03 익금 ····································· 132

실전문제 01 간주임대료(Ⅰ) ·································· 150

실전문제 02 간주임대료(Ⅱ)(2021. CPA) ·············· 153

실전문제 03 의제배당(Ⅰ) - 잉여금의 자본전입 ··· 155

실전문제 04 의제배당(Ⅱ) - 자본감소 ·················· 158

실전문제 05 의제배당(Ⅲ)(2020. CPA) ················· 160

실전문제 06 의제배당(Ⅳ)(2017. CTA) ·················· 162

실전문제 07 채무출자전환 채무면제이익,

의제배당 (2018. CPA) ····················· 165

실전문제 08 자본준비금을 감액하여 받은 배당 ····· 167

실전문제 09 의제배당과 수입배당금

익금불산입(Ⅰ)(2019. CPA) ·············· 169

실전문제 10 의제배당과 수입배당금

익금불산입(Ⅱ)(2018. CTA) ·············· 172

실전문제 11 수입배당금 익금불산입(Ⅰ) ················ 177

실전문제 12 수입배당금 익금불산입(Ⅱ)(2016. CTA) ·· 179

실전문제 13 수입배당금 익금불산입(Ⅲ)(2003. CPA) ·· 181

실전문제 14 수입배당금 익금불산입(Ⅳ)

(2017. CPA) ···································· 184

실전문제 15 내국법인 및 외국자회사의 수입배당금

익금불산입 (2023. CPA) ·················· 187

실전문제 16 외국자회사 등 수입배당금 익금불산입 190

실전문제 17 주식의 취득, 처분,

평가 및 배당 등(Ⅰ)(2002. CPA) ······ 193

실전문제 18 주식의 취득, 처분,

평가 및 배당 등(Ⅱ)(2007. CPA) ······ 195

실전문제 19 주식의 취득, 처분, 평가 및 배당 등(Ⅲ) · 197

법인법세인법세 법총 론총 론 1 1- 5- 5

2024 세무회계연습

CHAPTER 04 손금 I ··································· 200

실전문제 01 손금과 손금불산입의 세무조정 ·········· 226

실전문제 02 세금과 공과금(Ⅰ) - 기본문제 ·········· 230

실전문제 03 세금과 공과금(Ⅱ) - 취득세 등 ········ 232

실전문제 04 세금과 공과금(Ⅲ) - 부가가치세 ······· 234

실전문제 05 인건비(Ⅰ) - 기본문제 ····················· 236

실전문제 06 인건비 등(Ⅱ)(2020. CPA) ················ 238

실전문제 07 인건비(Ⅲ) - 손금배분의 원칙 ·········· 240

실전문제 08 기업업무추진비(Ⅰ)(2016. CTA) ········ 242

실전문제 09 기업업무추진비(Ⅱ) ··························· 244

실전문제 10 기업업무추진비(Ⅲ)(2021. CPA) ········ 246

실전문제 11 기업업무추진비(Ⅳ)(2020. CTA) ········ 249

실전문제 12 기업업무추진비(Ⅴ)(2019. CPA) ········ 251

실전문제 13 기업업무추진비(Ⅵ) - 자산계상

기업업무추진비 (2017. CTA) ············ 254

실전문제 14 기업업무추진비(Ⅶ) ··························· 256

실전문제 15 기업업무추진비(Ⅷ)(2022. CTA) ········ 258

실전문제 16 문화기업업무추진비(Ⅰ) ····················· 262

실전문제 17 문화기업업무추진비(Ⅱ)(2022. CPA) · 264

실전문제 18 문화기업업무추진비(Ⅲ)(2020. CPA) · 266

실전문제 19 문화 기업업무추진비 및 전통시장

기업업무추진비(2017. CPA) ············· 268

실전문제 20 문화기업업무추진비·기업업무추진비

한도 축소대상 법인(2018. CTA) ······· 271

실전문제 21 기업업무추진비 - 수입금액 ·············· 273

실전문제 22 기업업무추진비와 기부금(2014. CPA) 276

실전문제 23 기부금(Ⅰ) ········································ 280

실전문제 24 기부금(Ⅱ)(2016. CPA) ····················· 282

실전문제 25 기부금(Ⅲ)(2015. CPA) ····················· 284

실전문제 26 기부금(Ⅳ)(2021. CPA) ····················· 287

실전문제 27 기부금(Ⅴ)(2018. CPA) ····················· 289

실전문제 28 기부금(Ⅵ)(2023. CPA) ····················· 292

실전문제 29 기부금(Ⅶ)(2019. CTA) ····················· 295

실전문제 30 기부금(Ⅷ)(2020. CTA) ····················· 299

실전문제 31 기부금(Ⅸ)(2023. CTA) ····················· 302

실전문제 32 기부금(Ⅹ) ········································ 305

실전문제 33 기부금(ⅩⅠ)-오류수정 ························· 308

실전문제 34 지급이자 손금불산입(Ⅰ)(2023. CTA) 311

실전문제 35 지급이자 손금불산입(Ⅱ) ··················· 313

실전문제 36 지급이자 손금불산입(Ⅲ)(2023. CPA) ··· 316

실전문제 37 지급이자 손금불산입(Ⅳ) ··················· 318

실전문제 38 지급이자 손금불산입(Ⅴ)

- 건설자금이자(특정차입금) ·············· 321

실전문제 39 지급이자 손금불산입(Ⅵ) ··················· 323

실전문제 40 주식선택권 (2017. CTA) ·················· 325

CHAPTER 05 손금 II

(유·무형자산의 감가상각) ···· 328

실전문제 01 감가상각시부인계산(Ⅰ)

- 기본문제(2005. CPA) ··················· 346

실전문제 02 감가상각시부인계산(Ⅱ)

- 즉시상각의제 ······························· 348

실전문제 03 감가상각시부인계산(Ⅲ)(2014. CPA) ·· 351

실전문제 04 감가상각시부인계산(Ⅳ) - 손상차손,

손상차손환입(2023. CTA) ················· 353

실전문제 05 감가상각시부인계산(Ⅴ)

- 손상차손, 자산감액분(2022. CPA) 355

실전문제 06 감가상각시부인계산(Ⅵ)(2020. CPA) · 358

실전문제 07 개발비(Ⅰ) ········································ 360

실전문제 08 개발비(Ⅱ)(2017. CTA) ····················· 362

실전문제 09 재평가모형, 개발비 ··························· 364

실전문제 10 건설자금이자와 개발비(2018. CPA) ·· 366

실전문제 11 사용수익기부자산(Ⅰ) ························ 369

실전문제 12 사용수익기부자산(Ⅱ)(2018. CTA) ····· 370

실전문제 13 정률법의 상각범위액과

비망가액(2018. CPA 1차) ················ 372

실전문제 14 수정내용연수 ···································· 373

실전문제 15 감가상각방법 및 내용연수의 변경 ····· 374

실전문제 16 감가상각방법의 변경(2023. CTA) ····· 376

실전문제 17 상각부인액 사후관리 - 양도 ············ 378

실전문제 18 상각부인액 사후관리 - 평가증 ········· 380

실전문제 19 감가상각의제(Ⅰ) ······························· 381

실전문제 20 감가상각의제(Ⅱ)(2013. CPA) ··········· 382

실전문제 21 감가상각의제(Ⅲ)(2015. CPA) ··········· 384

실전문제 22 감가상각의제와 감가상각방법의 변경

(2023. CPA) ···································· 386

실전문제 23 감가상각의제와 건설자금이자(2019. CTA) ·· 389

1 - 6 법인세법

실전문제 24 장부가액이 시가(또는 취득가액)에

미달시 감가상각비 ···························· 392

실전문제 25 국제회계기준 적용법인의 감가상각비

손금산입특례(Ⅰ) ······························· 395

실전문제 26 국제회계기준 적용법인의 감가상각비

손금산입특례(Ⅱ) ······························· 397

실전문제 27 국제회계기준 적용법인의 감가상각비

손금산입 특례(Ⅲ)(2017. CPA) ········· 400

실전문제 28 업무용승용차(Ⅰ)(2019. CPA) ··········· 402

실전문제 29 업무용승용차(Ⅱ)(2017. CPA) ··········· 404

실전문제 30 업무용승용차(Ⅲ)(2016. CTA) ··········· 407

실전문제 31 업무용승용차(Ⅳ) ······························· 410

실전문제 32 업무용승용차(Ⅴ) - 임차·렌트 ········ 413

CHAPTER 06 충당금과 준비금 ··················· 416

실전문제 01 대손금 등 ········································· 443

실전문제 02 대손금과 대손충당금(Ⅰ)

(1단계:전기말 유보의 추인) ············ 445

실전문제 03 대손금과 대손충당금(Ⅱ)

(2단계:당기 대손금관련 세무조정) ·· 447

실전문제 04 대손금과 대손충당금(Ⅲ)

(3단계:당기말 채권잔액관련 세무조정) · 450

실전문제 05 대손금과 대손충당금(Ⅳ)(2023. CTA) ··· 453

실전문제 06 대손금과 대손충당금(Ⅴ)(2022. CPA) ·· 456

실전문제 07 대손금과 대손충당금(Ⅵ)(2020. CPA) ·· 459

실전문제 08 대손금과 대손충당금(Ⅶ)(2015. CPA) ·· 462

실전문제 09 대손금과 대손충당금(Ⅷ)(2019. CTA) ··· 465

실전문제 10 대손금과 대손충당금(Ⅸ)(2017. CPA) ·· 469

실전문제 11 퇴직급여충당금(Ⅰ) ··························· 472

실전문제 12 퇴직급여충당금(Ⅱ) ··························· 474

실전문제 13 퇴직급여충당금(Ⅲ) - 과소상계 ········ 478

실전문제 14 퇴직급여충당금(Ⅳ)

- 퇴직금 중간정산 ··························· 481

실전문제 15 퇴직급여충당금(Ⅴ) - 월차결산 ········ 483

실전문제 16 퇴직급여충당금(Ⅵ)

- 특수관계회사간 전출입 ················· 485

실전문제 17 퇴직급여충당금(Ⅶ) - 합병 ··············· 487

실전문제 18 퇴직연금충당금(Ⅰ)(2016. CPA) ········ 488

실전문제 19 퇴직연금충당금(Ⅱ) ··························· 490

실전문제 20 퇴직연금충당금(Ⅲ)(2019. CPA) ········ 492

실전문제 21 퇴직금추계액(2022. CTA) ················· 495

실전문제 22 일시상각충당금 - 보험차익 ·············· 499

실전문제 23 일시상각충당금

- 국고보조금(자산차감법) ················· 500

실전문제 24 일시상각충당금 - 국고보조금

(이연수익법)(2019. CTA) ·················· 501

실전문제 25 복구충당부채(2023. CPA) ················· 503

실전문제 26 환불충당부채(2021. CPA) ················· 505

실전문제 27 고유목적사업준비금(2013. CPA) ······· 507

CHAPTER 07 부당행위계산의 부인 ············· 510

실전문제 01 고가매입·저가양도(Ⅰ) ···················· 521

실전문제 02 고가매입·저가양도(Ⅱ)(2017. CTA) · 522

실전문제 03 고가매입·저가양도(Ⅲ) ···················· 523

실전문제 04 고가매입·저가양도(Ⅳ) ···················· 525

실전문제 05 자산의 부당임대차 등 ······················· 526

실전문제 06 가지급금인정이자(Ⅰ)(2018. CPA) ···· 527

실전문제 07 가지급금인정이자(Ⅱ) ························ 530

실전문제 08 가지급금인정이자(Ⅲ)(2007. CPA) ···· 532

실전문제 09 가지급금인정이자(Ⅳ) ························ 534

실전문제 10 부당행위계산의 부인

- 종합(2022. CPA) ·························· 536

실전문제 11 불공정합병(Ⅰ) ·································· 538

실전문제 12 불공정합병(Ⅱ)(2011. CPA) ·············· 540

실전문제 13 불공정합병(Ⅲ)(2018. CTA) ·············· 542

실전문제 14 불균등증자(저가발행Ⅰ)(2007. CPA) · 544

실전문제 15 불균등증자(저가발행Ⅱ)(2012. CPA) · 547

실전문제 16 불균등증자(고가발행)(2019. CTA) ····· 552

실전문제 17 불균등감자(Ⅰ) ·································· 556

실전문제 18 불균등감자(Ⅱ)(2013. CPA) ·············· 558

실전문제 19 불균등감자(Ⅲ)(2023. CPA) ·············· 561

실전문제 20 불균등감자(Ⅳ)(2021. CTA) ·············· 564

법인법세인법세 법총 론총 론 1 1- 7- 7

2024 세무회계연습

CHAPTER 08 과세표준과 세액계산 ············· 570

실전문제 01 결손금 이월공제 ······························· 600

실전문제 02 결손금 소급공제 ······························· 602

실전문제 03 토지 등 양도소득에 대한 법인세(Ⅰ) 604

실전문제 04 토지 등 양도소득에 대한 법인세(Ⅱ)

(2020. CTA) ···································· 605

실전문제 05 토지 등 양도소득에 대한 법인세(Ⅲ) 607

실전문제 06 결손금 소급공제와 토지 등 양도소득에

대한 법인세(2021. CTA) ·················· 608

실전문제 07 미환류소득에 대한 법인세(Ⅰ)

(2019. CTA) ···································· 611

실전문제 08 미환류소득에 대한 법인세(Ⅱ)

(2015. CPA) ···································· 614

실전문제 09 외국자회사 수입배당금 익금불산입과

외국납부세액공제 ······························ 617

실전문제 10 외국납부세액공제(2014. CPA) ·········· 619

실전문제 11 외국납부세액(2016. CTA) ················· 621

실전문제 12 재해손실세액공제(2022. CPA) ·········· 623

실전문제 13 연구·인력개발비 세액공제(Ⅰ) ········· 625

실전문제 14 연구·인력개발비 세액공제(Ⅱ) ········· 627

실전문제 15 결손금소급공제와 연구·

인력개발비세액공제(2015. CPA) ······· 628

실전문제 16 중소기업특별세액감면(2005. CPA) ··· 631

실전문제 17 최저한세 제도(Ⅰ) - 기본문제 ·········· 633

실전문제 18 최저한세 제도(Ⅱ)(2021. CPA) ········· 634

실전문제 19 최저한세 제도(Ⅲ)(2012. CTA) ········· 637

실전문제 20 최저한세 제도(Ⅳ) (2019. CTA) ········ 640

실전문제 21 최저한세 제도(Ⅴ)(2022. CTA) ········· 642

실전문제 22 최저한세 제도(Ⅵ)(2011. CPA) ········· 646

실전문제 23 최저한세 제도(Ⅶ)(2015. CTA) ········· 648

실전문제 24 최저한세 제도(Ⅷ)(2018. CPA) ········· 652

CHAPTER 09 법인세 납세절차 ··················· 656

실전문제 01 신고불성실가산세 및 납부지연가산세 693

실전문제 02 경정고지 및 가산세(2007. CPA) ······ 695

실전문제 03 중간예납세액(Ⅰ) ······························· 697

실전문제 04 중간예납세액(Ⅱ)(2016. CPA) ··········· 699

실전문제 05 중간예납세액(Ⅲ)(2023. CTA) ··········· 702

실전문제 06 중간예납세액(Ⅳ)(2010. CPA) ··········· 705

실전문제 07 청산소득금액(Ⅰ) ······························· 707

실전문제 08 청산소득금액(Ⅱ)(2020. CPA) ··········· 709

실전문제 09 청산소득금액(Ⅲ)(2015. CTA) ··········· 711

실전문제 10 청산소득금액(Ⅳ)(2018. CPA) ··········· 713

실전문제 11 연결납세제도(Ⅰ)(2010. CPA) ··········· 715

실전문제 12 연결납세제도(Ⅱ) ······························· 718

실전문제 13 연결납세제도(Ⅲ) ······························· 721

실전문제 14 연결납세제도(Ⅳ)(2022. CTA) ··········· 722

실전문제 15 연결납세제도(Ⅴ)(2017. CTA) ··········· 726

CHAPTER 10 합병 및 분할의 과세특례 ······ 732

실전문제 01 합병에 대한 과세체계(Ⅰ)

- 기본문제 ······································· 753

실전문제 02 합병에 대한 과세체계(Ⅱ)

- 자산조정계정과 유보승계 ·············· 755

실전문제 03 합병에 대한 과세체계(Ⅲ)

- 영업권(2004. CPA) ······················ 758

실전문제 04 과세이연의 중단 ······························· 760

실전문제 05 피합병법인 주주의 합병으로

인한 의제배당 ·································· 761

실전문제 06 합병에 대한 과세체계(Ⅳ)

(2022. CTA) ···································· 763

실전문제 07 포합주식 등(Ⅰ)(2017. CPA) ············ 767

실전문제 08 포합주식 등(Ⅱ)(2020. CTA) ············· 771

실전문제 09 합병에 대한 과세체계(Ⅳ)

- 불공정합병(2005. CPA) ················ 774

실전문제 10 합병차익의 자본전입으로 인한

의제배당소득 ···································· 776

실전문제 11 합병 전에 보유하던 자산의 처분 ······ 778

실전문제 12 분할에 대한 과세체계(Ⅰ)

- 인적분할 ······································· 780

실전문제 13 분할에 대한 과세체계(Ⅱ)

- 물적분할 ······································· 782

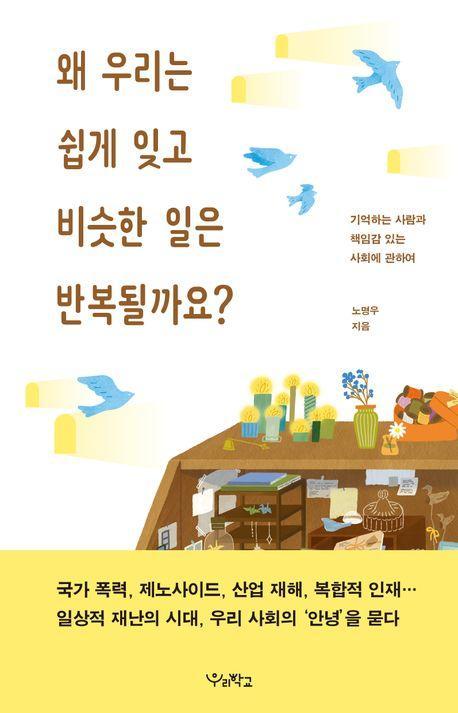

왜 우리는 쉽게 잊고 비슷한 일은 반복될까요

도서명 : 왜 우리는 쉽게 잊고 비슷한 일은 반복될까요

저자/출판사 : 노명우, 우리학교

쪽수 : 208쪽

출판일 : 2024-04-16

ISBN : 9791167552419

정가 : 15800

1. 금요일에 돌아오지 못한 2014년의 열일곱 살이 있습니다

2. 달력에 표시되지 않은 재난도 있습니다

3. 희생자의 눈으로 재난을 바라봅니다

4. 재난 이후 우리는 반격과 기억의 갈림길에서 어디로 가게 될까요?

5. 기억은 우리 모두가 책임지겠다는 약속입니다

6. 우리 모두는 재난에 연루되어 있습니다

7. 혼자 걷게 하지 않도록 함께 부르는 노래

댓글목록0